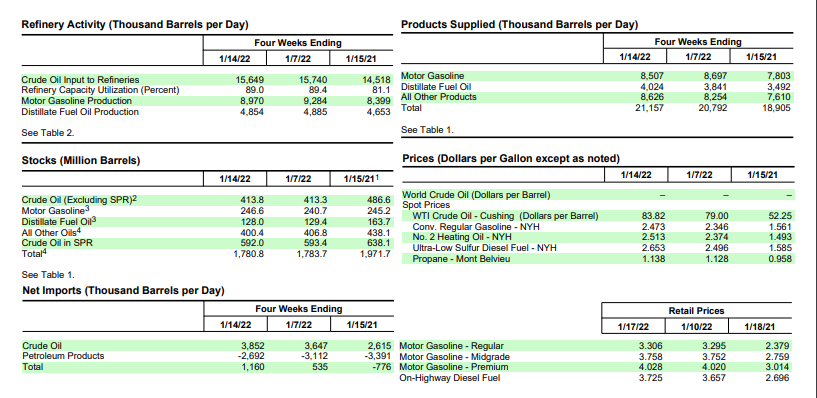

There’s been a great deal of concern lately over the topic of inflation. Often times signs of future trends can be gleaned from the weekly EIA Oil Inventory report. A number of really unusual movements occurred in oil markets this past week, which led to oil prices falling right around $2 per barrel on Friday, January 21st. Looking at the chart at the bottom of the report, we see that oil refinery activity slowed in the past week and total output fell by around 91,000 barrels per day. Gasoline production fell off by over 300,000 barrels per day, yet stocks still increased. The real change in the report is apparent in the “Net Imports” block, where we see the value for exports (the number in that section is negative because the US exports more refined petroleum products than it imports – US refineries import raw crude, refine it, then ship it back overseas) has declined by over 400,000 barrels per day, suggesting oil demand in other countries is slackening.

Products supplied to market in the United States has also declined by 190,000 barrels per day, which is likely to be related to reports that around 8% of the American workforce is out sick with Covid. The key factor to watch will be what happens with exports of refined oil products. Wars are expensive, and if Russia thinks they’re about to go to war with Ukraine then they are likely to invest heavily in expanding their production capacity and over-produce, trying to sell more oil than they originally agreed to in recent production cap negotiations with other OPEC+ nations to try to help cover the cost of that conflict. If that happens then oil refiners in the US may continue to see declining sales in overseas markets, as they get priced out by Russian oil being sold at “fire sale” prices. That creates an incentive for the Biden Administration to maintain diplomatic pressure on the Russians over the conflict in Ukraine, as over-production of oil by Russia could help to reduce inflation pressures in the United States by moderating oil prices.